“What’s Really Happening Behind America’s Rising Debt”

In recent months, money has quietly become one of the biggest sources of tension in everyday life — not through dramatic headlines, but through the steady pressure building behind the scenes.

Across the United States, households are leaning more heavily on credit than at any time in recent memory. Total credit-card debt has surged past $1.21 trillion, with nearly three-quarters of that borrowing tied to everyday essentials like groceries, rent, and utilities. The average balance per user sits around $5,595, showing just how deeply borrowing has become woven into daily survival rather than luxury spending.

This pressure isn’t happening in a vacuum. Interest rates remain stubbornly high — averaging close to 21% on many credit cards, roughly double what they were a decade ago.

That means every purchase carried month-to-month grows heavier, turning small balances into long-term burdens and reshaping how families plan their futures.

The strain has sparked political debate and policy proposals. One high-profile initiative suggested temporarily capping credit-card interest rates at 10%, an idea supporters say could ease borrowing costs for consumers — though financial institutions warn such limits could restrict access to credit for many people altogether.

The discussion reflects a broader reality: there’s no easy solution to a system where affordability pressures and access to credit are tightly intertwined.

Meanwhile, uncertainty stretches beyond credit cards. Surveys show many consumers heading into 2026 feel both hopeful and anxious about their finances — with over half expecting prices to worsen, and about one-third unsure they could handle a major economic setback.

Debt has become part of that emotional landscape, shaping decisions about investing, saving, and risk-taking.

Housing adds another layer to the story. Mortgage rates have stabilized near 6.1%, easing slightly from last year but still contributing to slower home sales and affordability challenges — even as buyers gain more negotiating power and inventory improves.

For many families, borrowing for a home remains both an opportunity and a gamble, influenced by policy shifts and market expectations.

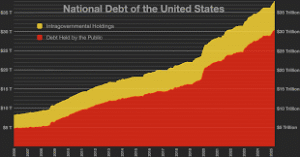

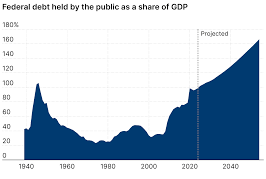

Zooming out further, economists see 2026 as a balancing act — an economy showing resilience on the surface while deeper structural pressures build beneath it. Rising national debt servicing costs, uneven wealth distribution, and aggressive investment trends could widen gaps between those thriving financially and those falling behind.

All of this paints a complex picture:

Credit is not just a financial tool anymore — it’s a reflection of modern survival, ambition, and risk. People borrow to bridge gaps, chase opportunities, and maintain stability, yet each swipe carries consequences shaped by forces far beyond individual control.

The story unfolding today isn’t about a single crisis or headline moment.

It’s about millions of small decisions — loans taken, balances carried, investments attempted — forming a quiet narrative about how ordinary people navigate an increasingly complicated financial world.

And as interest rates shift, policies evolve, and markets react, one truth remains clear:

The relationship between debt, opportunity, and security will continue shaping lives long after the news cycle moves on.